Rent and Service Charges

Town & Country Housing is a not-for-profit organisation. This means that the money you pay through your rents and service charges goes towards maintaining existing homes and services. This page gives further information about how your rent and service charges are calculated and what they cover.

Rent

This is a charge for the use of your home. The level of rent charged will depend on your property’s attributes, such as whether it is a house or a flat, how many bedrooms it has etc. It is a regulatory requirement for us to set our rents as determined by the government or your lease.

How do I pay my rent?

Although we offer several ways that you can pay your rent, we strongly encourage all our tenants to pay by Direct Debit.

Setting up a Direct Debit is the easiest, most convenient and effective way for you to pay your rent. You choose the payment dates and frequency to suit eg. weekly, fortnightly or monthly. Call us on 01892 501480 to set up your Direct Debit.

Note: You need a bank account or similar that will allow direct debit payments to be taken from it. To save time when you call please have your account details to hand.

Direct Debit FAQs

Direct Debit is by the far the easiest, most convenient and effective way for you to pay your rent. If your tenancy started after the 1st April 2017 you will have been required to pay by Direct Debit as part of your tenancy. Everyone else will be asked to move from existing methods of payment to direct debit.

- It’s easy to set up, simply call one of our advisors and they can arrange for you.

- Payments are automatically taken from your account on the date and frequency that you’ve agreed.

- We will always give you advance notice if the date or amount changes.

- You are covered by the Direct Debit Guarantee. If an error is made a full refund is paid by us or your bank or building society.

- You have the right to cancel at any time. If you do so, please let us know so that we can assist you with an alternative payment method.

- No more worries about forgetting to pay your rent on time.

- You’ll find it easier to stay on top of your rent, helping you budget and plan your finances.

- Details of payments made to us will show on your bank or building society statement. We will also send you a regular statement of account at least every quarter to help you check your rent account balance.

You are always in control. We tell you initially of the amounts and payment dates giving at least twelve working days notice required by the Direct Debit scheme. The same applies to any changes that may be made.

Other Ways to Pay

If for some reason you are unable to set-up a Direct Debit, we do offer other ways for you to pay your rent:

You can arrange to pay by standing order, you will give the bank an instruction to pay an exact amount to another account regularly.

Payments can be made through MyHomeOnline with a debit card – such as Maestro, Delta or Switch – or by Credit Card.

You can pay your rent online. If you have a smartphone, you can pay your rent using the free Allpay app. The app is available to download free of charge from the Apple App store and Google Play. The Allpay App is free to use, but some network operators may charge for some services such as downloading or using the App, so please check with them.

Local shops and businesses displaying a PayPoint sign outside will take your rent using the swipe card. You should ensure you pay no later than the Wednesday of the payment week. Find your local PayPoint.

You can pay your rent over the phone by calling our customer service team on 01892 501480.

What rent applies to me?

Social rents

Social rents (general needs, affordable, sheltered, supported and intermediate tenancy types) are regulated by the government. The regulations do not apply to leaseholder and market rents. Your lease or tenancy agreement contains clauses which detail how rent increases are calculated for your individual property.

Shared ownership rents

Shared owners pay rent on the share of the property that they do not own. For example, if you have purchased a 40% share in the property, you will pay rent on the remaining 60%. Your lease contains clauses which detail how rent increases are calculated for your individual property.

How have you calculated my rent?

Notice of Rent Increase

In February of each year you will receive a written notice of the upcoming April rent change, but we wanted to give you more information here about how our rents are set.

The 2020 Rent Standard

Government policy tells housing associations how to set their rents. The government’s policy on rents for social housing has been revised. The new rules were applied from 1 April 2020.

The government has set a ‘long-term rent deal’ for both local authority landlords and housing associations. This allows annual rent increases on both social rent and affordable rent properties of up to Consumer Price Index (CPI) plus 1% from April 2020, for at least the next five years*.

The long-term rent deal will generally apply to social rents for tenants whose tenancies continue in their current homes.

* Please note where your payments include a separate service charge element this is not affected by the rent standard. Service charges are calculated according to reasonable estimates and actual expenditure and can go up or down.

Rent Flexibility Level (applicable to new social housing lettings)

The government’s policy recognises that housing associations should have some say over the rents they set for individual properties. This allows them to consider local factors and concerns, in consultation with tenants.

So, the rent standard contains flexibility for housing associations to set rents at up to 5% above formula rent (10% for supported housing). If applying rent flexibility, landlords should give clear reasons for doing so, which consider local circumstances and affordability.

From April 2020, we have applied the 5% flexibility to all new social housing lettings. This will ensure that rents are affordable for our tenants while we have adequate income to manage and maintain our properties (our core services such as repairs and housing management are paid for by our rental income – you can see more details about how your rent is spent on the Annual Report to Tenants pages on our website).

Our reasons for using the 5% flexibility are:

- It works out less than if we charged the government defined affordable rent. We have reviewed how affordable our properties are and have concluded that charging social rent at target rent (see rent policy background below) plus 5% will generally allow us to keep rents lower in most areas than if we charged the government defined ‘affordable rent’ on new lettings. Where this is not the case (because areas have comparatively low rents and house prices) like in parts of East Kent, affordable rent may be charged if this is the lowest rent option. We will always set our rent to the lower option.

- We have an ambitious development programme supported by a strong business plan, with targets to increase the number of new properties started on site to 800 homes a year by 2021-22. We aim to do this to help meet the urgent demand for good quality housing that people can afford; helping us to provide social housing to new residents. Our ability to develop 800 new homes each year depends on several factors; charging social rent at 105% of target rent, which helps demonstrate our financial viability to lenders, is a key one.

Rent Policy Background

Social Rents

Since 2001, ‘social rents’ (This means most traditional housing association rental properties) have been set based on a formula set by government. There is a ‘formula rent’ for each property, which is calculated based on the value of the property, local income levels, and the size of the property.

The Rent Cap

A ‘rent cap’ applies to formula rents. The rent cap is the maximum that can be charged and depends on the size of the property (based on number of bedrooms). Where the formula rent would be higher than the rent cap for a property, the rent cap rate must be used instead.

Affordable Rent

In 2011, the government introduced ‘affordable rent’ which allows some housing association rents (inclusive of service charges) to be set at up to 80% of local market rent. The higher rent levels were introduced to help housing association develop more properties for those in housing need, as direct government grant funding for this is limited.

Full Market Rent

From April 2015, the government made it possible for social landlords to charge a full market rent where a social tenant household has an annual income of at least £60,000. We took the decision not to use this policy as it would not be possible to apply it fairly because housing associations cannot legally require tenants to provide us with changes to their income details once they have moved into a property.

Why does my neighbour pay a different amount of rent than me?

Rent is set on several factors from tenure, target rents and government policy (see ‘How have you calculated my rent’ above). Your rent can differ from your neighbours due to these, even if you are in similar properties. We will never discuss your rent with other residents, or theirs with you, due to General Data Protection Regulation (GDPR).

What is Experian’s Rental Exchange?

Renters sometimes struggle to open bank accounts, get affordable loans, credit cards or a mortgage because they don’t have a credit history (a track record of paying off credit agreements). Companies use credit history to assess your creditworthiness before making a lending decision.

We’ve signed up with Experian to take part in The Rental Exchange to help strengthen your credit report without you needing to take on new credit. We share details about the rent you pay with Experian on a monthly basis. This is included in your credit report, meaning you will then be recognised for paying your rent on time.

Having a good credit history also helps to prove who you are, and where you live and have lived before. This can help you to a range of goods and services online, such as better deals on mobile phones, TV and broadband packages and car insurance.

Homeowners with a mortgage have an advantage as their payment history can count towards their credit history. We strongly believe that your rent payment history should be used in the same way to help you access more affordable credit. There is a legitimate interest in the sharing of data for these purposes, which forms our legal ground for the sharing of this data into the Rental Exchange. Landlords who share data into Rental Exchange will have a legitimate interest in being able to make use of this data to support better informed tenancy decisions.

Not only will we be able to work with you more closely to manage your existing tenancy agreement, your track record as a tenant will enable Experian to use the information supplied to them to assist other landlords and organisations to:

- Assess and manage any new tenancy agreements you may enter into;

- Assess your financial standing to provide you with suitable products and services;

- Manage any accounts that you may already hold, for example reviewing suitable products or adjusting your product considering your current circumstances;

- Contact you in relation to any accounts you may have and recovering debts that you may owe;

- Verifying your identity, age and address, to help other organisations make decisions about the services they offer;

- Help to prevent crime, fraud and money laundering;

- Screen marketing offers to make sure they are appropriate to your circumstances;

- For Experian to undertake statistical analysis, analytics and profiling,

- And for Experian to conduct system and product testing and database processing activities, such as data loading, data matching and data linkage.

More information about this and how credit reference agencies use and share rental data as bureau data (including the legitimate interests each pursues) is provided here – www.experian.co.uk/crain (Credit Reference Agency Information Notice). For a paper copy, please get in touch with us or with Experian.

We will continue to exchange information about you with Experian while you have a relationship with us. We will also inform Experian when your tenancy has ended and if you have outstanding rent arrears Experian will record this outstanding debt. Experian will hold your rental data for the time limits explained in CRAIN (section 7). Rental data falls into the Identifiers (e.g. your name, address, date of birth) and financial account categories (i.e. tenancy account, rental payment information).

We and Experian will ensure that your information is treated in accordance with UK data protection law, so you can have peace of mind that it will be kept secure and confidential and your information will not be used for marketing purposes.

If you would like advice on how to improve your credit history you can access independent and impartial advice from www.moneyadviceservice.org.uk (you can get a copy of your Statutory Credit Report by visiting www.experian.co.uk/consumer/statutory-report).

If you are unhappy with anything relating to Rental Exchange, please contact us on info@tchg.org.uk. You can also get in touch with the Information Commissioner’s Office. More information can be found at: ico.org.uk/concerns/.

Standard information for new tenancy applications

In order to process your application, we may perform credit and identity checks with Experian. Where you take services from us, we may also make periodic searches with Experian to manage your account with us.

To do this, we will supply your personal information to Experian and they will give us information about you. This will include information from your application and about your financial situation and financial history. Experian will supply to us both public (including the electoral register) and shared credit, financial situation and financial history information and fraud prevention information.

We will use this information to:

- Assess your creditworthiness and whether you can afford to take on a tenancy;

- Verify the accuracy of the data you have provided to us;

- Prevent criminal activity, fraud and money laundering;

- Manage your account(s);

- Trace and recover debts; and

- Ensure any offers provided to you are appropriate to your circumstances.

When Experian receive a search from us, they will place a search footprint on your credit file (this will not be seen by other organisations).

What should I do if I have rent arrears?

Being in debt and having rent arrears can be a worrying and challenging time.

If you are having financial difficulties, it’s important you let us know as soon as possible. The earlier you let us know, the easier it will be to help you get back on track.

Depending on your circumstances, we would aim to make an arrangement with you to pay off your arrears gradually.

Why should I pay my rent?

It may sound obvious but if you don’t pay your rent you run the risk of losing your home. If you ignore your rent arrears, you may leave us with no choice but to take legal action to claim rent you have not paid.

Who can help?

We can! Contact us as soon as possible and ask to speak to your Income Manager.

Your Income Manager may get in touch to discuss your finances. This is nothing to worry about, but it is important you speak to them and keep them up to date on your circumstances.

They may go through your income and spending with you and together look at ways you could save money.

In some cases, we may refer you for additional support from our Money Support Team who will work with you more closely to help you deal with debts. We also have a Tenancy Sustainment Team who can help with underlying issues such as health or day to day living issues which may be impacting on your ability to sort out your finances and pay your rent.

Please contact us if you need help. Anything you discuss with us, will be in confidence.

What benefits am I entitled to?

If you are unsure what benefits you are entitled to, the best way to find out is to use Entitled To’s free benefit calculator.

Or if you prefer, speak to us and we can go through all your benefits including housing or universal credit and ensure you are getting everything you are entitled to.

For more information about Universal Credit, please follow the link: www.tchg.org.uk/what-is-universal-credit/

Who else can I speak to about my debts?

If you have concerns relating to debt, you may also benefit from contacting a debt charity like Stepchange, Money Advice Service, National Debtline or Citizens Advice for free, trusted, impartial debt advice.

You should never be charged for debt advice. Be cautious of other debt companies as you may find they charge a fee.

Service Charges

Service Charges

Service charges cover the costs of services provided in communal areas and around your property, in the estate, scheme and block of flats or houses that you live in. For example, communal cleaning, gardening, lift servicing, communal utility bills etc.

In some cases, personal service charges in your own home may be included such as water, heating and electricity.

We charge variable service charges. This means we estimate the costs for the upcoming year, and after the year ends we provide a statement of the actual cost of services and credit/debit the difference.

This is known as the surplus/deficit, i.e. a surplus credit due to you (shown as a minus, i.e. -£), or a deficit amount owed by you (shown as a £).

Town & Country is a not for profit organisation and we cannot make any profit from service charges. The variable service charges ensure you only pay for the services provided.

What is the difference between fixed and variable service charges?

Fixed service charges

Fixed service charges are when the services are estimated and set for the year.

If you live in an affordable, affordable sheltered, key worker, market rented or intermediate rented property you will be on a fixed service charge that is included in the total rent. We will not issue statements for fixed service charges.

Variable service charges

Variable service charges can change depending on the final costs at year end. This way the exact cost of service is included and any surplus or deficit is applied to our resident’s accounts. You will only ever pay the cost for the services provided.

If you live in a general needs, sheltered, supported, leasehold, shared ownership or private property you will be on a variable service charge.

What is the difference between eligible and ineligible service charges?

If you receive Housing Benefit to cover your rent most of your service charges will also be covered if your circumstances remain the same – these are eligible service charges.

Any personal service charges you may be charged for services provided in your own home (such as water, heating and electricity) are ineligible for Housing Benefit and will not be covered.

When do you send out service charge statements?

Estimated service charge statements

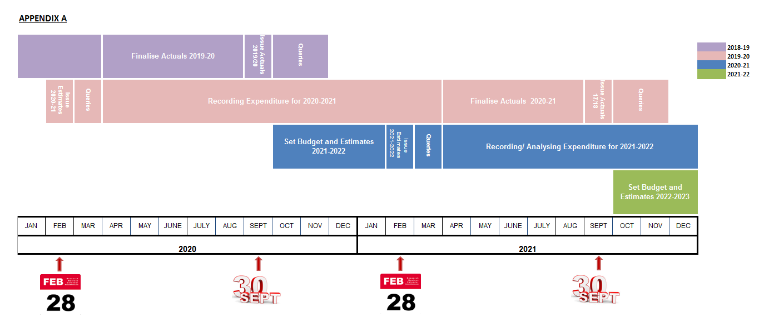

Every year around the 28th February we send you a letter explaining your rent increase and your service charge statement for the upcoming financial year, which runs from 1 April to 31 March in accordance with your tenancy agreement or lease.

Your service charge statement sets out the services you receive and your estimated share of the cost of these services. At the beginning of the year we do not know the exact cost for all the services. There are some costs that are fixed, but others vary depending on the service provided or any additional/unexpected work required, such as repairs. We therefore charge you based on an estimated cost using previous actual costs and current contract costs.

Actual year end service charge statements

At the end of the financial year in March, we then calculate the actual expenditure for your property for the year and issue your final actual statement by the end of September. If we have estimated more for the service costs than were charged in the final statement, you will receive a surplus/credit, if we have estimated less you will receive a deficit/debit.

- For our social residents the surplus/deficit is applied to the weekly service charge in the next financial year.

- For our leasehold/freehold residents the surplus/deficit is applied to your account balance.

As per the illustration below, you would be sent an estimated statement around 28th February 2021 for the 1st April 2021 to 31st March 2022 year and receive the actual statement around 28th September 2022, 18 months from the first charges from 1st April*.

You therefore will receive an estimate for the next financial period (2022/23) in February 2022 before the 2021/22 final accounts are issued.

*if we are unable to serve the accounts within the 18 month period (by the following September) we will issue a s20b notice which notifies you that a cost will be due, amount of the costs, and you will be required to pay that cost as a service charge at a later date.

Why do you send out statements?

It is a statutory requirement that if we charge you a variable service charge we make an adjustment to your account when we know the actual service cost and issue you a statement to show the breakdown of the service costs.

We want to be open and transparent with you about these costs and any adjustment arising, to make your statement as clear as possible. We have tried to keep this information as simple as possible but if you have any questions please contact us.

What is included in the service charge?

The following lists a short description of each of the service charges that may be payable for your property. It tells you how those charges are calculated and answers some frequently asked questions.

Social tenures (general needs, sheltered, supported housing) pay for any communal service that is not part of the fabric of the building (such as walls, roofs). For example, grounds maintenance, cleaning, communal utilities, door entry systems, lifts, fire safety systems.

Shared ownership or leasehold pay for any communal service and contribute to insurance costs for the building and may also contribute to a sinking fund for major works/replacement of roofs, windows etc.

For the specific service charges that apply to your home please see your service charge statement.

The items of expenditure that appear on the service charge summary are based on both fixed contract costs and predicted on non-fixed costs for the forthcoming year. Charges are payable in advance as laid out in your tenancy agreement.

Administration Fee (Social)

This is a flat rate of 15% charged on all service charges except contract management and equipment usage fund. This covers our administration and office costs, for example, the administration, calculation and collection of service charges and responding to residents enquiries. It also covers the costs of managing and supervising communal services, for example arranging repairs.

Audit Fee (Leasehold/Freehold)

This is the fee paid to the external auditors for reviewing the leasehold service charge accounts to ensure the invoicing and apportionment of costs are accurate. It is a statutory requirement under the Landlord & Tenact Act 1985 that an independent audit is carried out on any properties subject to variable service charges.

Buildings Insurance (Leasehold/Freehold)

The cost of insuring the structure and common parts of the block and/or estate. It does not cover your home contents. We strongly advise that you purchase home contents insurance to cover your belongings. We may not always insure your home if we are not the freeholder and the insurance may be included in a managing agents’ costs.

Bulk Rubbish

We remove any items left in the communal corridors as they pose a fire risk and will charge for this. We also charge for removing bulk rubbish, external fly-tipping or dumped furniture and white goods.

When we’re told someone is responsible for the dumped items then we will try to recharge them directly rather than apply a service charge to the entire block. If you witness one of your neighbours or someone else dump items in the communal areas, please contact us.

If you have items that you wish to dispose of that are too big for a household bin please contact your local authority and they may be able to collect these items from you.

Combined Cleaning

The service includes internal and external cleaning in communal areas. The charge includes our contractors’costs for their staff and equipment to carry out their work.

For flats and maisonettes, it includes:

- Sweeping / hoovering shared parts of a block

- Cleaning entrance halls and lifts

- Sweeping bin areas

- Removing low level graffiti

- Cleaning communal windows

- Removal of leaves from hard standing/car parking areas.

Other intensive cleaning work is carried out from time to time in addition to the above cleaning service. These services can vary from area to area.

If you live in a house or a bungalow then it may include cleaning of any shared/communal areas, for example sweeping or litter picking paths and car parks.

Communal Electricity

Communal electricity supply to all communal electrical installations such as communal lighting, pumping stations, lifts, door entry systems, car park, bike store and streetlights.

Communal Gas

Where we have a communal boiler supplying the heating and hot water to communal areas or properties.

Communal Lighting

Maintaining the lighting and other fixtures in your block or scheme. This also includes any inspections of communal lighting/wiring and replacing bulbs.

Communal Pumps

Cost of an annual service and repairs to the pumping station. The pumps may provide wastewater removal, drainage or water supply to blocks, estates or individual houses.

Communal Water

Supplying water to bin sheds, pumping stations or sprinkler systems and for laundry, communal kitchens, toilets and showers where applicable.

Contract Management

This is for a dedicated team at Town & Country to monitor the cleaning, caretaking and grounds maintenance contracts to ensure standards are met.

Door Entry

Servicing and repair of any communal door entry or gate system.

Equipment Usage Charge (Social)

To fund the replacement of communal items such as lift, entry phone, furniture, carpets in communal areas at the end of its life or the cost of providing the equipment in the first place. This will also include equipment in external areas such as play areas, car ports etc.

Equipment – Playgrounds

If you have a playground in the communal areas this will include any costs for maintenance, health and safety assessments or repairs.

External Managing Agent

In cases where we are obliged to use the services of an external managing agent. This is usually where:

- The homes are part of a larger estate which we do not own

- We lease homes from someone else

In these cases, the companies which do own the area instruct an external managing agent to maintain and manage the site on their behalf. The managing agent will deliver the services such as cleaning, grounds maintenance and any repairs and maintenance.

Fire Protection and Equipment

By law, we are required to have fire safety equipment in some blocks. Some blocks may not have fire protection equipment but will have a charge for the risk assessment carried out for the communal areas each year. This service covers the cost of maintaining any fire safety equipment and includes:

- Servicing and repairing fire alarm systems, emergency lighting systems, fireman’s switches and sprinkler systems in the communal areas

- Servicing and repairing dry risers which distribute water to different levels of a building

- Servicing and maintaining portable fire extinguishers and fire blankets

- Health and safety inspections

Grounds Maintenance and Gardening

This covers the cost of maintaining the communal grounds, lawns, shrubs or communal car parks that are there for everyone’s benefit. The cost of maintaining these areas is shared by the properties in that area. To find out how frequently these tasks should be carried out for your block, check the notice in your communal hallway.

If the service is provided in your area or estate then generally this will include:

- Grass cutting

- Shrubs and hedges on communal land will be trimmed/pruned twice a year, usually in July/August and then again in late autumn

- Weeding, weed killer spraying where necessary

Intensive Housing Management

This charge applies to all residents living in Sheltered Housing accommodation. This service is to provide a management function for residents to sustain their tenancy.

Internet Service / Alarm Monitoring Service

This is the provision, servicing and repair of the alarm system or appliances and / or internet service costs where we have provided this service.

Lifts

Quarterly maintenance inspections and any repairs of the lifts in communal areas.

Management fee (Leasehold/Freehold)

This is the charge for managing leasehold and freehold properties. This covers our administration and office costs, for example, the administration, calculation and collection of service charges and responding to leaseholder enquiries. It also covers the costs of managing and supervising communal services, for example arranging repairs.

Telephones – Lift or Door Entry

The line rental costs for lift lines and/or door entry lines. Lifts require phone lines for emergency call buttons and some door entry systems may utilise a telephone line for communication.

Tree Surgery

This represents the costs from undertaking tree surgery within communal areas. Works can relate to trees within the wider estate area in which you are a part of and not necessarily on your road.

Pest Control

This refers to the treatment that may be required within common parts for the prevention and extermination of pest infestations on your estate and/or block.

Private Garden

This is a charge for the maintenance of individual gardens which tenants in some areas can opt into if they have a need for this service. If you join the scheme you must commit to one year. You can ask to stop receiving the service on or around the anniversary.

If you wish to stop receiving the service before the anniversary of when you started receiving it, you will be liable to pay the charge for the whole year.

Personal Electricity, Gas and Water

This charge is applied when there is only one meter that provides the supply for gas, electricity or water to the communal areas and individual properties in one or more blocks, so individual properties don’t have their own meter.

Repairs

We estimate a fixed charge for flats and houses to contribute towards any repairs of communal systems. The expenditure for the repairs will be included under the service charge item for the communal system repaired, such as fire alarms, emergency lighting, lifts etc.

Sinking Fund (Leasehold)

This is the payment into a fund held by Town & Country Housing for the future capital costs of major items, such as redecoration and major repairs. This fund will also cover the costs of administering the major works. Any interest earned is added to the fund.

Water Hygiene Servicing

For legionella testing, risk assessments of water supplies and regular maintenance flushing of water systems. These are for the communal closed water systems that require regular maintenance.

How are my service charges appointed (divided up)?

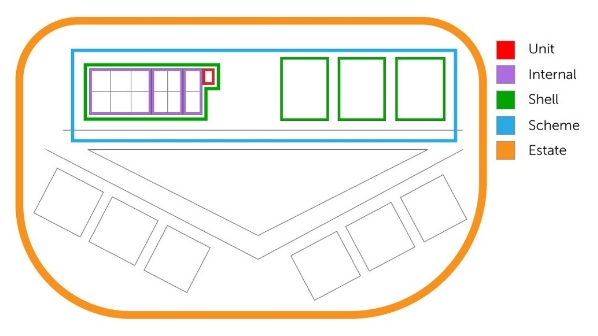

We apportion (divide up) your service charges over five tiers as illustrated below;

Estate: Services provided to grounds which may include several schemes or properties in which we do not own but a managing agent provides the estate services.

Scheme: A local area, usually a road or roads where your house or block of flats are located.

Shell: This represents properties that belong to the same roof or block space. Usually a block of flats but may exclude units that do not have access to internal communal areas but would contribute to fire safety measures for the building, i.e. ground floor units with street level access.

Internal: For the internal communal areas shared by a specific block of units, for example cleaning of internal corridors, lifts.

Unit: Charges for an individual property, usually relating to administration or audit.

Why are other managing agents costs included in my service charge?

Some developments in which your home is located were built by us, whereas others were built by private developers. Therefore, in the cases of developments built by private developers these will be managed by an external managing agent (EMA), rather than by us.

The developer will commission a managing agent to provide services to the whole estate, you will be recharged a fair percentage of these in your service charges. We may however still be providing services to areas of the estate along with any services within the blocks we own.

In the example below of one of our estates, we own the properties (highlighted in purple), car parks/drives (orange), alleyways (yellow) and hardstanding grounds (blue).

The managing agent would provide grounds maintenance and cleaning for all the other communal areas of the estate, we would provide some external grounds cleaning and maintenance as well as for any communal areas inside our blocks.

Why does someone in another block pay a different amount to me for the same service?

Each block, however similar, will have costs that can vary or have a different number of flats which may affect how costs are divided.

For example, one block may have more flats than another, so the costs are spread amongst more properties; this makes the cost per property lower. Some services may vary between blocks such as the area of grounds to be maintained, size of communal areas to be cleaned, equipment/services provided and/or residents requests for additional services. We will never discuss your service charges with other residents, or theirs with you, due to General Data Protection Regulation (GDPR).

Why have my service charges increased?

Each year before issuing estimates we will increase our contract prices by inflation and our contractors cost increases. Most services will increase by these factors.

We will also set estimates for any expected costs based on the most recent years actual costs. For example, there may be an increase in fly tipping on an estate which has caused large deficits for our residents’ final accounts. In order to limit this in future years we will set a budget for bulk refuse which may not have been present in previous estimates. As these ad-hoc works are dependant on whether fly tipping occurs, some or all of the cost may credited back when we issue the final actual accounts depending on if further incidents take place. We then review the next year’s estimates to see if the change can be reduced or removed.

However, any unexpected repairs, additional works or new services may not have been estimated for and can cause a deficit in the final actual accounts issued. As it is not possible to predict future system failures, fly tipping and other such unpredictable costs when we issue the final actual accounts you may have a deficit due to the cost of these unexpected works.

As estimates are set before the current year end final accounts are issued (see ‘When do you send out service charge statements?’ for the annual cycle) you may not see the changes take place until the following year.

Why do I pay for bulk refuse removal?

We have a responsibility to ensure the safety and standards of our communal areas. This includes removing bulk rubbish and fly tipping from our communal areas and estates. As this is on communal grounds, any clearance is rechargeable under service charges. The estate communal grounds may include other roads and communal areas nearby. These are only the areas we identify we have responsibility to maintain and are not pubic highway/council land where refuse removal would be covered under council tax.

Ideally, we aim to recharge the individuals responsible, however, this is not always possible if we not aware of who it was or have evidence to prove it. In these other cases all residents are given a shared percentage of the cost for removal.

If you have items that you wish to dispose of that are too big for a household bin, please take them to your local tip or contact your local authority who may be able to collect these items from you. This will prevent costs being passed on in the service charges.

If you identify anyone dumping bulk refuse please to report this to us if it is safe to do so. Information provided will be treated in strictest confidence.

I live in a house – Why should I pay service charges?

Some houses are subject to service charges as they form part of an estate and receive a range of services that are not included in the rent.

Such services included:

- Communal grounds maintenance

- Estate cleaning

- Street bulk refuse clearance

- Street lighting if the area has not been adopted by the council, even if the lamp post is not in the vicinity of your house

An external managing agent may be in place to provide these estate service charges to all residents within the area. In these cases you will be recharged the managing agent costs for the services they provide.

What do I contribute to my equipment usage fund for? (social rented properties)

An equipment usage fund is an annual contribution towards a specific cost that will occur in the future. For example, if you are a resident in a block of flats, we calculate the lifecycle of all the communal systems in the block.

For example, communal door entry systems have an estimated 20-year lifecycle. Around this time our surveyors will review the door entry system and it will be replaced to ensure it functions sufficiently and meets any current building standards.

Below is an example of systems that may be included in your equipment fund and estimated life cycles:

- Playground equipment – 25 years

- Lifts, Door entry systems, Kitchens (equipment only) – 20 years

- Electric gates – 16 years

- TV Aerial/Satellite dish, Smoke Alarms (linked) – 15 years

- Sheltered laundry room or lounges – 10 years

What do I contribute to my sinking fund for? (shared owners and leaseholders)

A sinking fund is an annual contribution towards a specific cost that will occur in the future.

For example, if you are a resident in a block of flats, we calculate the lifecycle of all the communal systems in the block.

If a lift is expected to cost £42,000 to replace in 30 years, to cover the cost of replacing the lift over its lifecycle the block would need to contribute £1,400 each year. Each year this cost would be divided between all the residents. If the block contained 40 flats each resident would contribute £35 per year of the £1,400.

Below is an example of systems that may be included in your sinking fund and estimated lifecycles;

- Roofs – 50 to 60 years

- Windows, entry doors, communal doors – 35 years

- Lifts, door entry systems, CCTV equipment, paving/footpaths – 20 years

- Fire alarms, communal boilers, internal lighting, fire communal ventilation – 15 years

- Flooring – 10 years

- Internal decorations (painting etc) – 7 years

Do I get my sinking fund contribution back if I sell my property? (shared owners and leaseholders)

No. For sinking funds to be fair they spread the cost of replacing systems over the time in which all residents, past, present and future, use them. This way future residents are not given large bills for replacing systems shortly after moving in that they have not benefited from for the previous years.

As part of the sales process a solicitor should establish if there is a sinking fund for the building, and this should be accounted for in the overall value/saleability price of the property.

What is ground rent and why am I paying it?

This is a rent that a leaseholder or a shared owner must pay as a condition of the lease. You must pay the ground rent to the ‘freeholder’ of the land. Where we own an estate, we will recharge the ground rent by invoicing you each year. The charge will be applied to a sundry account separate from your rent account.

If we are not the owner of the estate and there is a managing agent, we will be invoiced by the freeholder and will collect the money to pay it directly to the freeholder. We will invoice you a demand separately as required by law.

When does communal cleaning and grounds maintenance take place?

Our various contractors have different schedules for their cleaning and grounds maintenance works. These can be fortnightly, monthly or quarterly depending on the level of maintenance agreed at the start of the contract.

The contractors may come at times when you are not home so you may not always see the service being provided. We have an obligation to maintain communal areas of blocks and set quality standards for our contractors. We inspect our estates and communal areas and have regular contractor meetings to review performance. Please let us know if you feel there are any issues with the contracts.

What help will I receive to pay my service charges?

If you claim Housing Benefit or Universal Credit towards your rent this will also include payment towards most service charges. The actual amount you receive will depend on your individual circumstances and you cannot claim for personal charges for water, heating and electricity within your home.

You can CLICK HERE for more information about the help that is available or contact our money support team for further advice.

How will service charges change in the future?

If there are any changes to any service charge contracts during the year, you will be notified as part of a consultation process. Once the consultation is concluded and the new contract agreed, taking consultation responses into account there will then be a 28 day notice period before the start of the revised or new service charge.

Service charges can increase or decrease without any limit, but we can only recover any reasonable costs. For example, it would be considered a reasonable cost if residents are consulted on a new service and this was subsequently introduced during the current financial year. The cost would not be estimated but would be included in the final actual statements and would cause a deficit.

What if I want to dispute my service charges?

If you have any queries about the services provided or the way we calculate your rent or service charges then please let us know via our Customer Service Team on 01892 501480 or info@tchg.org.uk to ensure your query is recorded, tracked and sent to the appropriate team.

You can also raise your query through My Home Online.

What are my legal rights on service charges?

Residents paying variable service charges have statutory rights under the Landlord & Tenant Act 1985, including;

- The right to consultation in advance of major works or long-term agreements (Section 151 and Section 20 consultation). This ensures that consultation takes place before agreeing any major works where costs exceed £250 per resident or any new service contracts where costs exceed £100 a year per resident. Any unexpected ad-hoc works, such as unexpected bulk refuse removal would not be consulted on.

- The right to be sent a Service Charges Summary of Rights and Obligations with any demand for service charge. We always include a copy of your Rights and Obligations with your final actual statement.

The right to request certified statements of account (and accompanying documentation) at your expense. You can request evidence of the costs included in the final actual accounts within 6 months of the statement being issued. You may be asked to pay a fee for the administration for providing the documentation. - The right to challenge the reasonableness of a service charge or the standard or a service at the First Tier Tribunal. If you believe a service cost is unreasonable, or that a service is not being delivered to a sufficient standard, you can dispute this with us, and we will investigate. If we do not uphold the dispute you can challenge this at a First Tier Tribunal.

My question isn’t answered in this FAQ?

If you’ve been unable to find an answer to your question in this FAQ, please contact us via our Customer Service Team with your query. Let us know it’s not answered here, we’ll investigate your query and if it’s a wider query that’s missing here we’ll add it to this FAQ to help other residents in the future.